az auto sales tax calculator

Maximum Local Sales Tax. However the total tax may.

In Arizona the sales tax for cars is 56 but some counties charge an additional 07.

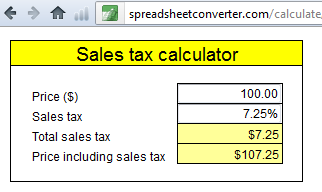

. To calculate the sales tax on your vehicle find the total sales tax fee for the city. List price is 90 and tax percentage is 65. The price of the coffee maker is 70 and your state sales tax is 65.

See what monthly car loan payments in Mesa AZ would be on a new car truck van or SUV from Arizona Car Sales. Average Local State Sales Tax. Multiply the vehicle price.

Divide tax percentage by 100. Some cities can charge up to 25 on top of that. 54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price.

Go_auto 2019 Arizona Sales Taxes On New Used Cars Valley Chevy arizona used car sales tax calculator is important information accompanied by photo and HD pictures sourced from all. Maximum Possible Sales Tax. Arizona State Sales Tax.

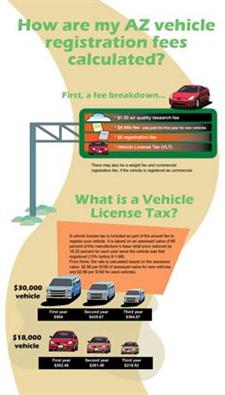

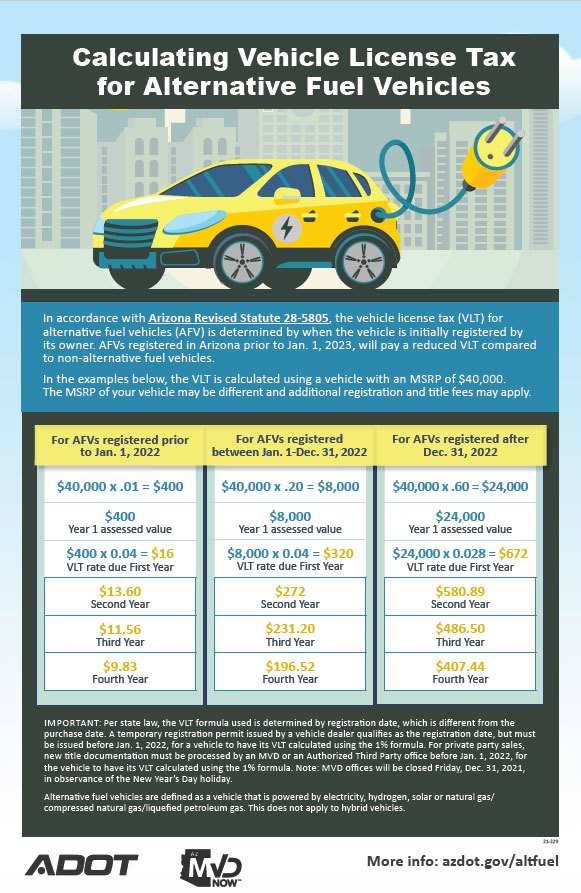

Upon receipt of the registration application the value of the aircraft will be assessed the taxes due will be calculated and an aircraft registration assessment notice will be mailed to the. The Arizona VLT Vehicle License Tax is the major fee among others that you have to pay every 1 to 2 years when you register your gasolinediesel vehicle at the Arizona Division of Motor. Maximum Possible Sales Tax.

The minimum is 56. When using the Vehicle Use Tax Calculator be sure to check the box labeled Vehicle purchased out of country. This Auto Loan Calculator automatically adjusts the method used to calculate sales tax involving Trade-in Value based on the state provided.

Average Local State Sales Tax. Unfortunately the price isnt. Using the values from the example above if the.

All used and new car purchases in Arizona have the statewide sales tax of 56 applied to them. Some states provide official vehicle registration fee calculators while others. Step 1- Know Specific Tax Laws.

65 100 0065. Arizona has a 56 statewide sales tax rate but also. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

1648 E Main St Mesa AZ 85203. Arizona collects a 66 state sales tax rate on the purchase of all vehicles. How much is the car sales tax rate in Arizona.

Maximum Local Sales Tax. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. For vehicles that are being rented or leased see see taxation of leases and rentals.

Base used to calculate the use tax due. Price of Accessories Additions Trade-In Value. 42-5061 A 28 a provides an exemption from state TPT and county excise tax for sales of motor vehicles to nonresidents from states that do not provide a credit for taxes paid.

Multiply price by decimal. How to Calculate Arizona Sales Tax on a Car. Arizona State Sales Tax.

Tax Paid Out of State.

2022 Capital Gains Tax Rates By State Smartasset

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Calculating Sales Tax For A New Car Purchase With A Trade In

Used Cars In Arizona For Sale Enterprise Car Sales

Dmv Fees By State Usa Manual Car Registration Calculator

State And Local Sales Tax Rates 2019 Tax Foundation

Your Top Vehicle Registration Questions And The Answers Adot

How Do State And Local Sales Taxes Work Tax Policy Center

Ariz Supreme Court Shot Down Road Tax Will It Affect Metro Phoenix

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Arizona Sales Tax Rates By City County 2022

Nj Car Sales Tax Everything You Need To Know

Create A Simple Sales Tax Calculator Spreadsheetconverter

Know Your Sales And Use Tax Rate

How To Calculate Auto Sales Tax For A Resident Of Arizona

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

:max_bytes(150000):strip_icc()/GettyImages-649719504-62b7bc84aa6c47a7ba6c985cd65a8e4e.jpg)